Certified Digitalisation

Reduce administrative costs and office space

What is certified digitization?

It is the technological process that allows, through the application of photoelectronic or scanner techniques, to convert the image contained in a paper document into a digital image encoded according to one of the standard formats in common use and with a level of resolution that is accepted by the State Tax Administration Agency.

This standard establishes the requirements that the digitalization process must comply with. These requirements for the user are none other than the use of certified scanning software approved by the State Tax Administration Agency (AEAT), such as Legal Snap Scan from ANF Autoridad de Certificación.

In this way, the user will be able to proceed to the certified scanning of invoices, substitute documents and any other documents that are kept in paper that have the character of originals.

The invoices, substitute documents and other documents thus digitized will allow the taxpayer to dispense with the paper originals that served as a basis for them.

Certified digitalization is regulated in art. 7 of Order EHA/962/2007, of April 10.

Save on logistics and paper management

Completely eliminates paper-based tax documents.

Let's move together towards a society where paper is a thing of the past Contribute to the preservation and care of the environment thanks to the mechanisms we offer you.

Large companies are already enjoying the benefits

What does it allow me to do?

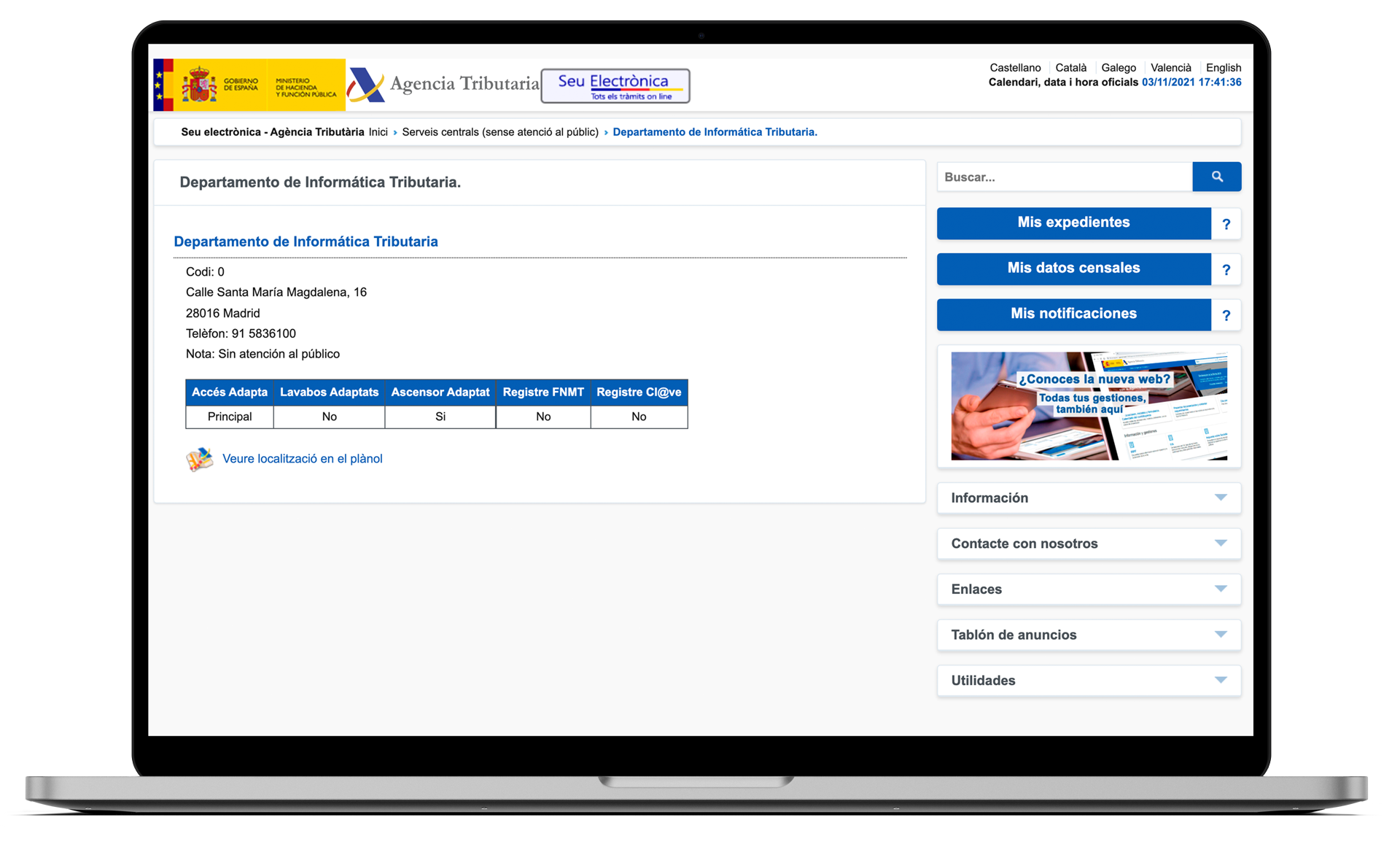

Quality management plan

The Quality Management Plan, is the process approved by Resolution of the Director of the Tax IT Department of the AEAT dated 26.11.2007, with reference 0B1F56D5A8E90CBB and its updated version 2.1 (23.10.2017), in accordance with Order EHA 962/2007 and the Resolution of 24 October 2007 of the AEAT.

Know the reference standards

Important note

We must remember that certified digitalisation allows the dematerialisation of a document, replacing the traditional paper support with electronic support, but the original document must be fiscally valid; a paper document that is not fiscally valid cannot acquire this validity by virtue of being digitally certified.