eFactura

Electronic Invoice

What is an electronic invoice?

An electronic invoice is an invoice—serving as proof of the delivery of goods or the provision of services—that is issued and received in electronic format, with the same legal validity as a paper invoice.

What is eFactura?

eFactura is an electronic invoice format used in Spain. It is an official standard for issuing electronic invoices that must meet specific technical and legal requirements. It is mainly used for issuing invoices to Public Administrations.

Thanks to its low cost and ease of use, it is a solution specifically designed for the self-employed, micro-enterprises, and small businesses. It is distributed through our network of franchise agencies and consultancies.

Thanks to its low cost and ease of use, it is a solution specifically designed for the self-employed, micro-enterprises, and small businesses. It is distributed through our network of franchise agencies and consultancies.

Thanks to its low cost and ease of use, it is a solution specifically designed for the self-employed, micro-enterprises, and small businesses. It is distributed through our network of franchise agencies and consultancies.

Ready to switch to e-invoicing?

With eSEAL Verifactu, you can easily comply with regulations while protecting your technical and legal security. Sign and submit your invoices with full confidence, preventing unauthorized access to your data by Public Administrations.

What is it for?

For many, preparing and sending invoices to Public Administrations, state-owned companies, and large corporations is a real ordeal. We simplify the process by removing the unnecessary and keeping only what matters: create the invoice, sign it, and deliver it to the recipient.

All invoices must ensure

The legibility of the invoice

The integrity of the content

The authenticity of origin

Modes of presentation

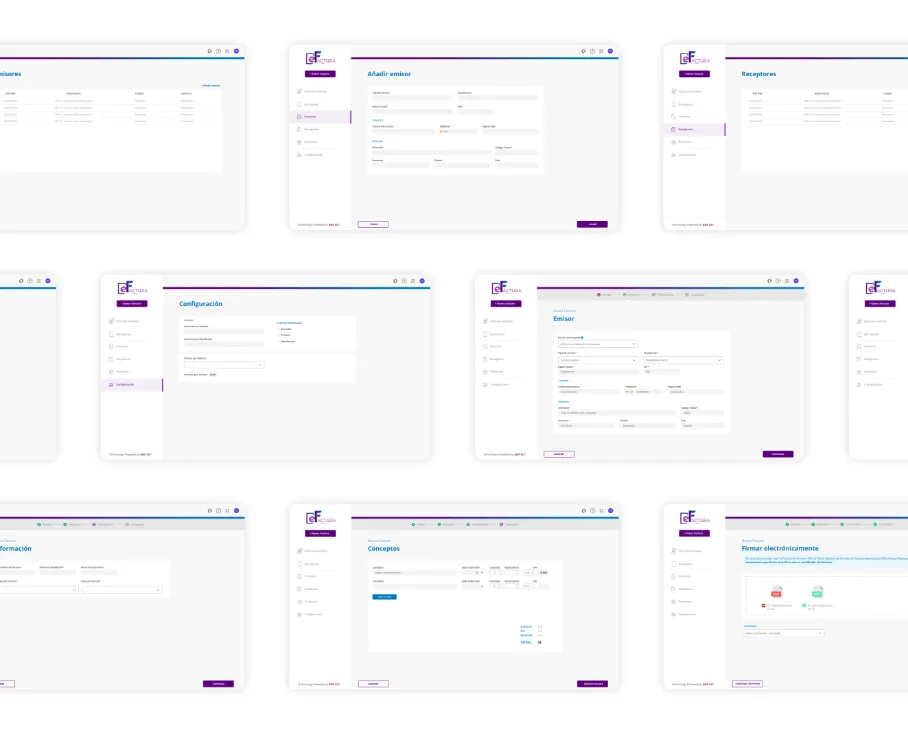

Desktop Application

1

Transform the document into the format required by the recipient.

2

Authenticate the document using an electronic signature.

3

Transmit it to the general entry point for invoices (FACe) of each Public Administration, as well as to other entry points of regional governments, provincial councils, local authorities, public companies, and large corporations. In addition, an Excel file is generated for your agency.

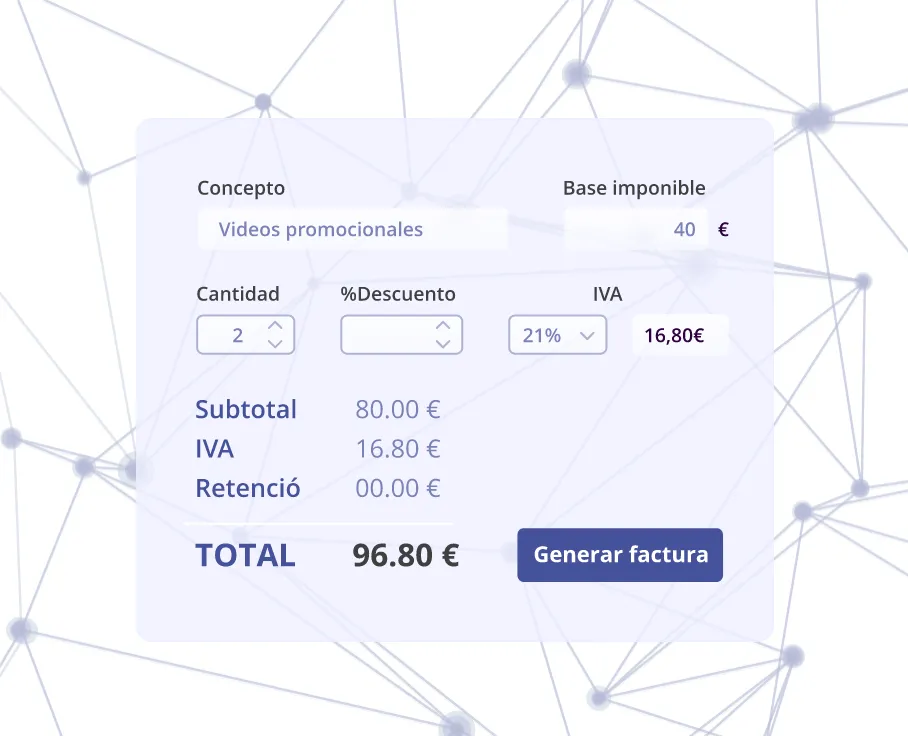

Format

The FacturaE 3.2 format is the standardized XML structure established for invoices that must be sent through the Spanish Tax Agency’s FACe portal. This structure includes all the required invoice fields.

Before being sent to the Public Administration, this XML file must be electronically signed. Once signed, the file takes the extension .XSIG (short for XML Signed).

A unique solution that your business needs:

Approval

Officially approved by the Tax Agency for Digitisation certified in accordance with the Resolution AEAT of October 24, 2007, click here.

Service providers

Service provider of electronic invoicing registered on FACe (Order PRE/2971/2007), click here.

Control of expenditure

Transformation of notes of expenses for the recovery of VAT, click here.

Conservation, custody and publication of documents authenticated by an electronic signature.

Qualified service technician in accordance with the Regulation (EU) eIDAS, and Royal Decree 1619/2012, click here.

Portals of electronic invoices

What are the benefits of using eFactura?

Reduction of costs

Less paper use and costs of shipping.

Greater efficiency

Automation of the billing process and the reception.

Security enhancement

Use of the electronic signature and validation of the information.

Legal compliance

Required to be checked to the Public Administration, which avoids penalties.

Legal regulations on which it is based the service

ANF Certification Authority meets all the minimum requirements laid down in the official state gazette number 313, December 30, 2021 for the category “electronic Invoice”:

- Bills in structured format

- Customers unlimited

- Products or services unlimited

- Sending invoices by e-mail

- Customize invoices

- Backup periodic

- 1 GB Storage/Historic invoice

- Integration with other solutions

- Control of the expiration of the bill

- Complies with the requirements of the Rules governing the invoicing obligations

Recognized by the Provincial treasury department

ANF AC is registered as software guarantor to the Provincial treasury department of Bizcaia, Gipuzkoa and Araba for complying with the requirements of TicketBAI

Always up to date

Enjoy a billing program rapid that requires no downloads or installations… you just have to connect

Flexibility

Manual generation and automatic e-invoices in XML format Facturae 3.2.2. and in PDF customizable.

International standards

Signature XaDES to FACe and e-FACT.

Integration with FACe

For sending invoices in a single click.

Legislation electronic billing

Law 25/2013, on the promotion of electronic invoicing and the creation of the accounting register.

- Royal Decree 1619/2012, of 30 November, approving the Regulation governing invoicing obligations.

-

Ministerial Order EHA/962/2007, of 10 April, developing certain provisions on telematic invoicing and electronic invoice storage contained in Royal Decree 1496/2003, of 28 November, approving the Regulation governing invoicing obligations.

Resolution of 24 October, of the State Tax Administration Agency, on the procedure for the approval of scanning software referred to in Order EHA/962/2007, of 10 April 2007.

Law 59/2003, of 19 December, on electronic signatures.

Law 15/2010, of 5 July, amending Law 3/2004, of 29 December, which establishes measures to combat late payment in commercial transactions.

Law 10/2010, of 28 April, on the prevention of money laundering and the financing of terrorism.

Cases of the most common uses

Issuance and management of electronic invoices with full legal validity, consistent with national and international regulations, including TicketBAI in Basque Country.

Automation of the full billing cycle for multiple customers, with fiscal control, generation of books, electronic signature and validation to the Treasury.

Create and send electronic invoices approved for official sites such as FACe or eFACT, complying with the Law 25/2013 impulse of electronic invoice.

Systems integration of business planning to issue, sign, register, and post invoices automatically and traceable.

Optimization of the billing process: issuance, electronic signature, auto-delivery, secure storage and full traceability.

Regulatory compliance guaranteed at all stages of the billing process, with legal custody of documents and supporting evidence to legal requirements or audits.

Electronic billing is adapted to specific requirements of the health sector, mutual funds and insurance companies, including integration with public health systems.

Massive generation automated, electronic invoices for individual customers or companies, the management of shipments, states, and archiving legal.

Compliance with the system TicketBAI, ensuring the issuance of invoices and tickets electronic under the requirements of the Provincial treasury department of Bizkaia, Gipuzkoa and Álava.

Solve all your questions

What is Facturae?

Facturae is an electronic invoice format used in Spain. It is an official standard for issuing electronic invoices that must meet specific technical and legal requirements. It is mainly used for issuing invoices to Public Administrations.

What is the structure of a Facturae file?

Facturae uses an XML file that contains the invoice information in a structured way. This file includes data such as the identification of the sender and recipient, invoice items, applicable taxes, date, invoice number, and the electronic signature.

Who is required to use Facturae?

All businesses and self-employed professionals issuing invoices to Public Administrations are required to use the Facturae format. This includes any provider of goods or services billing public sector entities, regardless of the amount.

What do I need to issue an invoice in Facturae format?

To issue an invoice in Facturae format, you need:

- Software that generates the XML file in Facturae format.

- A valid digital certificate to electronically sign the invoices.

- A delivery system, such as FACe (the General Point of Entry for Electronic Invoices), if the invoice is addressed to a Public Administration.

What is FACe, and how does it relate to Facturae?

FACe is the General Point of Entry for Electronic Invoices in Spain. It is a platform that allows providers to submit their invoices to Public Administrations. To be accepted, invoices must be in the Facturae format.

Is it safe to send electronic invoices through Facturae?

Yes, it is safe. Facturae requires the use of a digital certificate to electronically sign the invoice, ensuring the authenticity and integrity of the information. This guarantees that the invoice has not been altered and that the sender is who they claim to be.

What are the benefits of using Facturae?

The main benefits of using Facturae include:

- Cost reduction: Less paper usage and no shipping costs.

- Greater efficiency: Automation of invoicing and reception processes.

- Enhanced security: Use of electronic signatures and information validation.

- Legal compliance: Required for billing Public Administrations, helping to avoid penalties.

Can I use Facturae for invoices to private companies?

Although Facturae is designed for invoicing Public Administrations, it can also be used for invoicing private companies. However, it is not mandatory. Companies may agree on whichever electronic invoice format they prefer.

What is the current version of Facturae?

The latest stable version of Facturae is 3.2.2, although it is important to check the official Facturae website for updates or new releases. Each version may include adjustments and improvements to the standard.

How can I validate a Facturae file before sending it?

There are various free and paid tools available to validate a Facturae file before submission. On the Ministry of Finance portal and the FACe platform, you can find an online validator that checks whether the structure and data of the invoice are correct.

How can I obtain a digital certificate for signing Facturae invoices?

A digital certificate can be obtained through authorized certification authorities, such as ANF Certification Authority. The process usually involves submitting an online application and completing in-person identification at an authorized office.

What happens if an e-invoice is rejected by the Public Administration?

If an invoice is rejected, the sender must correct the errors indicated by the Administration and resend it. Common reasons for rejection include issues with the XML structure, incorrect data, or the absence of a valid electronic signature.

What is the difference between Facturae and other e-invoice formats?

Is it mandatory to keep invoices in Facturae electronic format?

Do you have any questions?

We're here to help

ANF AC needs the contact information that you provide to us to contact you about our products and services. You can unsubscribe from these communications at any time. For information on how to unsubscribe, as well as our privacy practices and commitment to protecting your privacy, see our privacy Policy.