PRODUCTS

Legal Snap Scan

Completely eliminates paper-based tax documents

Developed entirely by ANF AC, Legal Snap Scan is a certified digitization software, officially approved by the Spanish Tax Agency (AEAT), for the dematerialization of tax documents with full legal validity and guarantees. It enables the transformation of paper-based records into electronic format.

Dematerializes tax documents, enabling the destruction of the original paper.

It converts physical or electronic files into digitally encoded images, compliant with standard formats and the resolution requirements set by the AEAT. This ensures authenticity and full legal validity in any context where certified copies are required.

Why choose Legal Snap Scan?

- Integrates into any business process seamlessly, transparent to end users.

- Built-in Contingency Plan, includes a legally certified digital repository.

- Zero learning curve, no user training or enrollment required.

- Reduced costs in transport, storage, and paper management.

- Correct integration can cut hidden expenses by up to 20%.

- Recover VAT from the past four fiscal years.

A turnkey solution, officially approved by the Tax Agency.

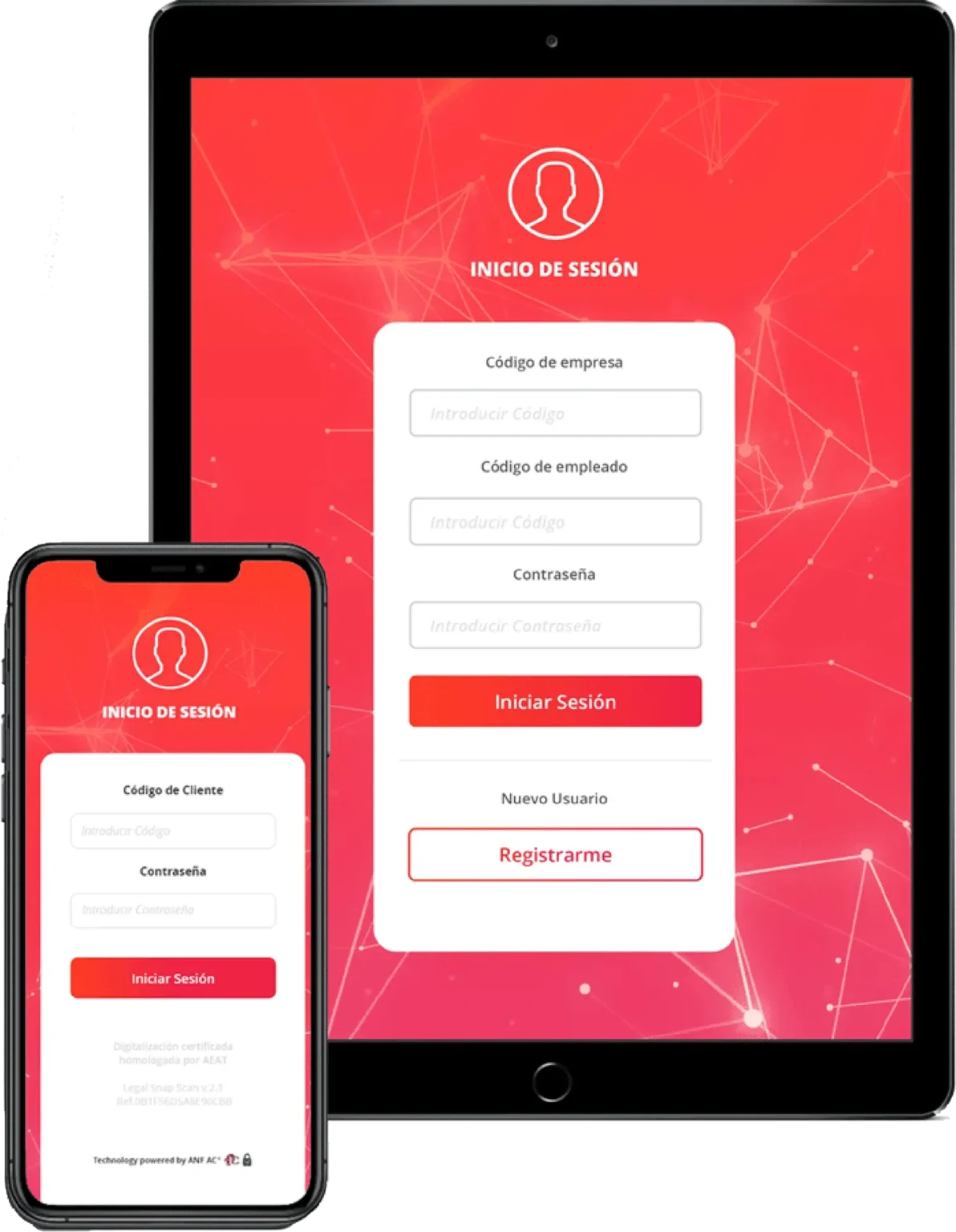

Transforms any mobile device into a certified scanner.

Integra LegalSnapScan en tus plataformas sin alterar los flujos de trabajo existentes.

Important Note

Certified digitization enables the replacement of paper documents with electronic versions, but only fiscally valid documents can be digitized. Paper documents lacking fiscal validity cannot acquire it by digital certification.

Facilitate compliant electronic archiving of documents in accordance with Tax Agency requirements.

Eliminate paper by implementing certified digitization of invoices and documents in full compliance with regulatory requirements.

Seamlessly integrate certified, digitized documents into accounting and tax processes within the ERP.

Associate certified invoices with clients and transactions, ensuring traceability and legal backing for every operation.

Enable the digital management of certified commercial documentation, supporting both internal processes and audit requirements.

Ensure regulatory compliance through the certified digitization of invoices and documentation subject to tax inspections

Facilitate compliant electronic archiving of documents in accordance with Tax Agency requirements.

LEGAL SNAP SCAN® Quality Management Plan

The Quality Management Plan is an AEAT-certified process, approved by Resolution of the Director of the Department of Tax IT Services dated 26.11.2007 (Ref. 0B1F56D5A8E90CBB) and updated under version 2.1 (23.10.2017), in compliance with Order EHA 962/2007 and the AEAT Resolution of 24 October 2007.

Know the reference standards

What is Legal Snap Scan?

Since when has the service been certified?

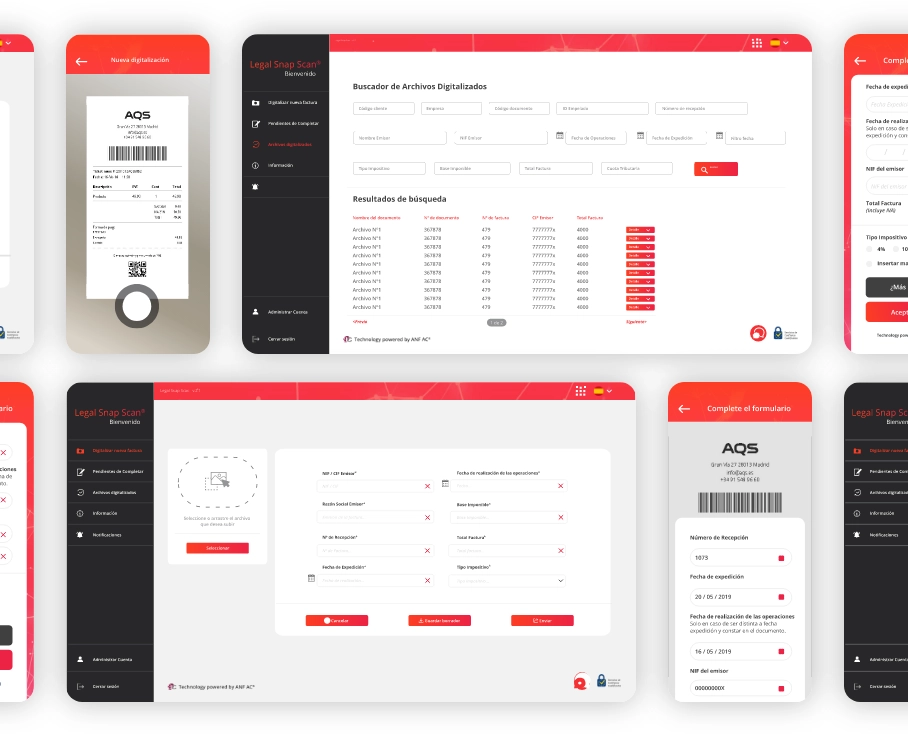

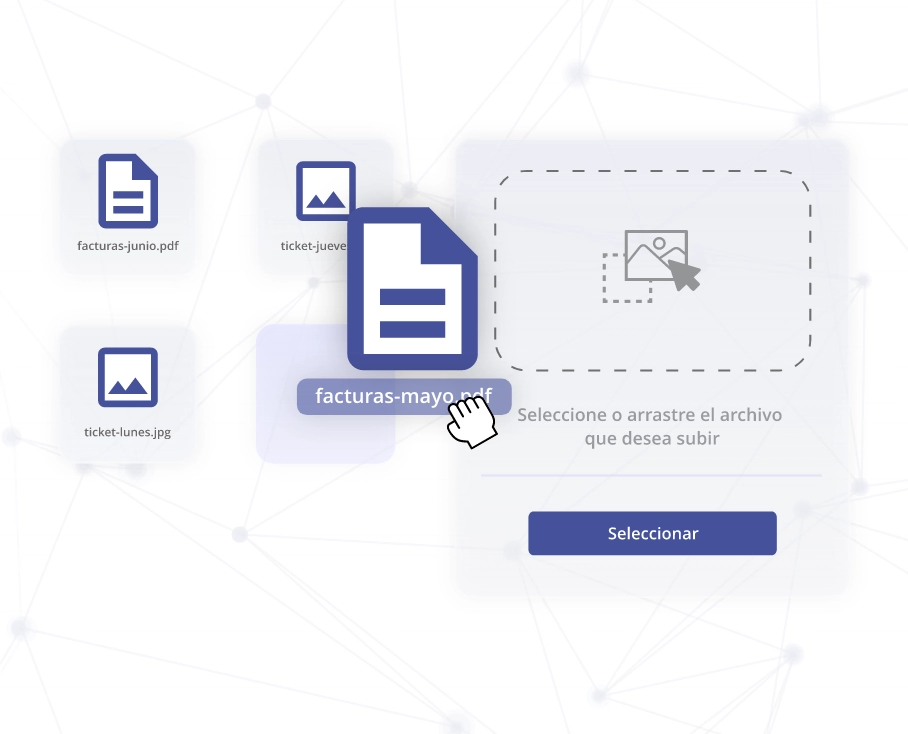

What are the options for document capture and upload?

Three modes are available:

- API upload

- Smartphone App upload

- Web upload

Accepted formats: JPEG, JPG, PDF.

How is certified digitization performed?

Files are processed on ANF AC servers, where they are enriched with metadata, digitally signed, hashed, and structured according to regulatory requirements.

What options exist for storage and publication?

- Return of documents: After processing, files are returned to the client.

- Custody and publication by ANF AC: Secure storage and publication for the duration of the contract, ensuring accessibility for AEAT inspections.

What does the custody and publication service include?

What are the platform requirements?

The AEAT mandates:

Printing digitized documents in PDF 417 format.

Display of structured economic data from invoices.

Metadata validation.

Signature validation to ensure integrity.

How is Legal Snap Scan packaged for use?

It is a ready-to-use product, available via web and smartphone applications. Ideal for sales departments to digitize receipts and invoices upon receipt.

What is the VAT recovery service?

An additional service that automates VAT accounting and submission to the AEAT. Companies can reclaim VAT from current expenses and up to four past fiscal years, while maintaining original copies and backups of tax documentation.

How does Legal Snap Scan integrate with other systems?

Through its API, Legal Snap Scan integrates seamlessly with ERP or invoicing systems, streamlining tax document management.

Do you have any questions?

We're here to help

ANF AC needs the contact information that you provide to us to contact you about our products and services. You can unsubscribe from these communications at any time. For information on how to unsubscribe, as well as our privacy practices and commitment to protecting your privacy, see our privacy Policy.